Globe Telecom has reported an indisputable strong showing of GCash, its digital financial platform for the year 2025.

In a disclosure report to the Philippine Stock Exchange, Globe stated that Mynt, the parent company of GCash, delivered a solid performance in the past year.

“The Company demonstrated resilience, supported byhealthy transaction volumes and sustained profitability. Mynt continued to enable the growth of digital finance through its payments, lending, and financial management services, extending access to millions of Filipinos nationwide,” the report stated.

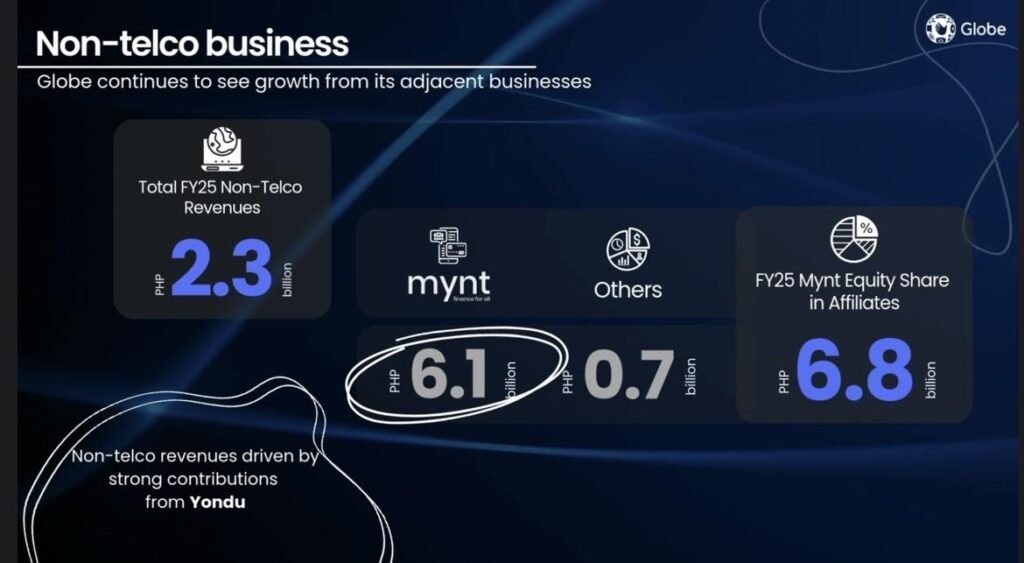

For the full year ended December 2025, Globe’s equity share in Mynt amounted to ₱6.1 billion, contributing around 22% of the Company’s pre-tax income. Mynt was a significant contributor to Globe’s earnings and a cornerstone of its digital ecosystem, supporting the country’s ongoing digital and financial inclusion efforts. In comparison to the third quarter, Globe’s equity share in Mynt in the fourth quarter was affected by three factors.

They include a change in accounting policy for loan processing fee revenue recognition, regulatory change on licensed online gaming, and seasonally higher spending in the fourth quarter.

Nonetheless, Mynt’s full year performance remains strong, underpinned by the rapid growth of its CreditTech business and supported by its core payments and transfers business.

For full-year 2025, Globe posted net income of ₱23.3 billion, slightly lower from ₱24.3 billion in 2024, driven by elevated depreciation and interest expenses. The total includes non-recurring items such as gains from the deemed disposal of Mynt shares related to MUFG’s equity investment earlier in the year, as well as gains from the tower sale and lease back deal. Excluding these one-off items, normalized net income ended at ₱20.8 billion, lower by 4% year-on-year.

Core net income, which removes the impact of non-recurring items such as asset sales, foreign exchange movements, and mark-to-market adjustments, amounted to ₱20.9 billion, compared to ₱21.5 billion in the previous year.

As of end-December 2025, Globe maintained a solid financial position, with total debt of ₱256.3 billion, up 3% from ₱249.5 billion at the end of 2024. The increase came from prudent funding activities that supported ongoing capital investments. Leverage ratios stayed well within covenant thresholds, with Gross Debt to EBITDA at 2.63x, Net Debt to EBITDA at 2.38x, and a Debt Service Coverage Ratio of 3.20x. These metrics demonstrate Globe’s discipline in managing its capital structure and preserving balance sheet strength.

The outstanding performance of Gcash has earned even the admiration of Manny V. Pangilinan, chairman of PLDT, considered as Globe competitor.